CREDITO — The Future of Credit Intelligence

Credito adalah jaringan analisis kredit desentralisasi yang memberikan nilai kredit, biaya transaksi dan pasar kredit yang didukung oleh Ethereal, kontrak intelektual dan IPFS, meningkatkan transparansi dan keandalan.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Problem Credito

Despite the efforts made by banks, card issuers, and merchants, credit card fraud continues to grow faster than credit card spending. Data breaches have resulted in more card details being compromised, and the growth in online shopping has led to more opportunities for ecommerce fraud.

Security

The recent Equifax hack exposed 140 million+ identities and personal information to the hackers and termed as the worst security breach in US history.

Centralized Information

The data collected by credit bureaus is centralized. It is a common misconception that these bureaus exchange information automatically, which is not true. These agencies are separate businesses providing similar services for a fee.

Monopoly

The global credit intelligence is controlled by a handful of credit bureaus, and it has been alleged many times that their scoring models are outdated, flawed, and not portable as they are specific to a country or a region. “More than one in five consumers have a ‘potentially material error’ in their credit file that makes them look riskier than they are, and consumers contacted one of the big three credit reporting agencies to dispute information Eight million times an year”.

Portabilitas

Karena nilai kredit tidak dapat dipindahtangankan, peminjam berisiko rendah dapat ditolak akses terhadap kredit saat mereka pindah ke luar negeri, dipaksa untuk mengembalikan kelaikan kredit mereka dari nol.

Analisis usang dan informasi yang tidak lengkap

Bila informasi menjadi lebih terpusat, maka monopoli dan tidak lengkap. Hal ini menyebabkan keputusan tanpa informasi yang tersedia, yang sangat meningkatkan risiko terkait. Selain itu, nilai kredit tidak diperbarui secara real time, dan penundaan ditentukan oleh jutaan konsumen dan perusahaan, karena sejarah kredit mereka saat ini tidak diperhitungkan dalam proses pengambilan keputusan.

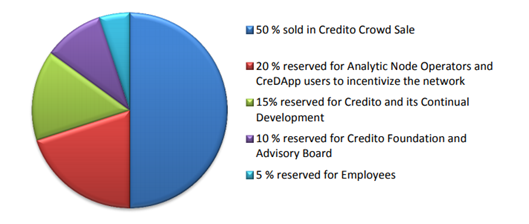

Token distribution

- Projected use of fundsEmployee allocation will have a vesting period of 12 months, 25% vesting each quarter, with a 6 month cliff. Allocation will be proportional to the tenure of each employee by the date of token sale.

- Credito Foundation allocation will have a vesting period of 12 months.

Credito dibangun untuk masyarakat. Kami menghargai masyarakat dan akan terus berinteraksi dengan ilmuwan data, pakar di lapangan, ilmuwan dan pakar keamanan untuk peer review. Kami mendorong pengujian, audit dan bukti keselamatan resmi, semua dengan tujuan menciptakan platform yang kehandalan dan keamanannya dapat mendukung inovasi masa depan.

More about Credito :

Website: https://credito.io/

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

LinkedIn: https://www.linkedin.com/company/credito-network

Whitepaper: https://credito.io/pdf/whitepaper.pdf

Facebook: https://www.facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

LinkedIn: https://www.linkedin.com/company/credito-network

My bitcointak: https://bitcointalk.org/index.php?action=profile;u=989135

Комментариев нет:

Отправить комментарий